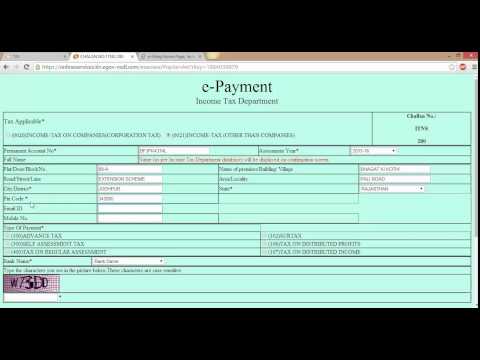

Hi friends myself with Lola again then from London tourism in this tutorial I am going to show you how to believe your advance - clarity online as you all know ma for company's first installment is due on 15th of June and for non problems first installment of advance taxes is due on 13th of September so today is the last day for pivot of nuance tenses as far as companies are concerned so here we go I am on to Google this type team - understeer and the first link will appear click on this that is www.ravistailor.com because services go to leave them in manually they are different challenge out of which you have to select an undo in T then again you have to select X income types of companies in Japan certain companies if I have a company then I will select this option in this radio button if I am a non company I was selling this one so since I am an individual I will select this if you are a company and paying the advance nestle then you should select this radio button I will select this option and then I will type a number this one here is 1516 flat number 89 a raga station a little fool state Rajasthan and input stop off shipping so you can't escape this even if you want to mention that so K you can mention otherwise you can skip it plus there is no stigma over here that means it is not compulsively now the most important of most important thing type of paving that is you have making advanced tenses payment and select this radio button if you have been the self-assessment class sonic this one if you are paying any if you...

Award-winning PDF software

Pay taxes online Form: What You Should Know

File and Pay Other Taxes Online Learn about IRS tax forms, resources, and services by going to IRS.gov. File Your Returns All income is taxable whether you receive it from the government or not. Taxpayers must file tax returns to accurately and completely calculate and report their income from various sources. You need to pay your taxes in compliance with all applicable laws and federal and state laws. Learn about the penalties for missing tax filings, penalties for late filing, or filing a return late.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1040-V IRS online, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1040-V IRS online online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1040-V IRS online by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1040-V IRS online from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Pay taxes online