Probably the best way to pay your estimated taxes is to go to your phone your smartphone and download the IRS to go mobile app so once again that's IRS the number two and then go do mobile app, and you can check the refund status make a payment and I think that they're going to add things like your transcripts perhaps in the future I did a Google search here for IRS estimated tax payments and there's one here that says direct pay I do want to go to yet but the form that we're really dealing with is called a 1040 BS and this is the PDF form of that I'll open that up, and it's 12 pages long you really only need the vouchers here, and they work from the bottom up, so you would tear off or cut off the bottom one and then the second one is June 15th and the third one September 17th and so on for the year that you're working on you, you absolutely have to make sure that if you're sending it in as an estimated payment for that particular year that you have that year's voucher if you've missed a payment or a quarter just don't worry about it just go to the next one and send it in a little early or a little late just write in your journal when you actually mailed it in okay let's go to this a direct pay it's going to ask you for the reason, and it's an estimated payment, and it will auto-populate that BS 1040 BS remember that's the form that we're after, and then you want to confirm the year now an BS will always be estimated or your current year go ahead and click continue and yeah...

PDF editing your way

Complete or edit your irs form 1040 v anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export form 1040 v directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your 2020 form 1040 v as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your irs gov form1040v by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form 1040-V IRS Online

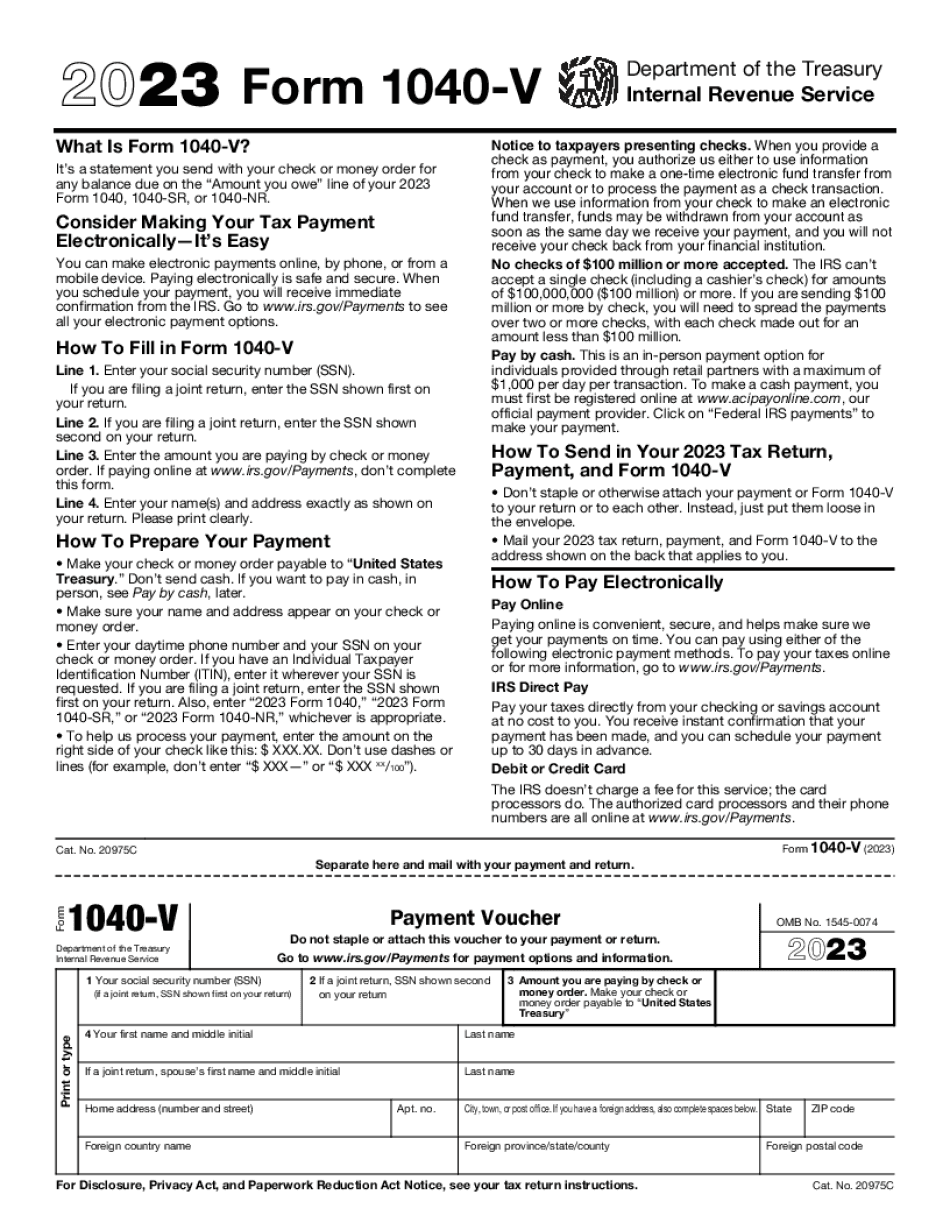

What Is Irs Gov Form1040v?

Form 1040-V, Payment Voucher for Form 1040, is a document that you may send in along with your check payment in case you owe the IRS when filing. This paper accompanies Form 1040, Form 1040-A and Form 1040-EZ.

The document is optional, i.e. the Internal Revenue Service will accept your payment without the form 1040-V. In case you decide to attach it, the IRS will process payments more efficiently.

Prepare the file electronically by choosing a blank and filling it out with required details. Online documents may be edited, signed and sent to recipients by email, fax or sms. Eliminate the hassles of routine paperwork with the help of digital samples in the PDF format.

Open the blank template. Click the ‘Text’ button to start providing the information. In order to find out what type of data is important to include, read the instruction below:

- Pryour Social Security Number on Line 1. In case you are filing a joint return, then you have to indicate the SSN shown first on your return.

- On Line 2 write the SSN shown second on your return.

- Specify the amount you are paying by check (or money order) on Line 3.

- Enter your name and address as shown on your tax return on Line 4.

Once you have completed, review the data on errors and correct any before it’s too late. Then save the Payment Voucher to your device and forward it along with other necessary papers we mentioned above. Note that you may use any internet-connected device to complete the procedure.

Online alternatives help you to prepare your doc management and enhance the productivity of one's workflow. Adhere to the quick guide as a way to complete Form 1040-V IRS Online, steer clear of mistakes and furnish it within a well timed manner:

How to finish a Form 1040 V?

- On the website using the variety, click Get started Now and pass to the editor.

- Use the clues to complete the applicable fields.

- Include your own information and facts and get in touch with information.

- Make sure which you enter appropriate facts and figures in suitable fields.

- Carefully verify the subject material in the sort at the same time as grammar and spelling.

- Refer to help you portion for those who have any problems or handle our Help team.

- Put an digital signature in your Form 1040-V IRS Online along with the enable of Indicator Tool.

- Once the form is finished, push Completed.

- Distribute the all set sort by using email or fax, print it out or conserve on the device.

PDF editor lets you to definitely make alterations with your Form 1040-V IRS Online from any World Wide Web related gadget, customise it as reported by your requirements, signal it electronically and distribute in numerous approaches.

What people say about us

The best way to fix errors made in the doc

Video instructions and help with filling out and completing Form 1040-V IRS Online