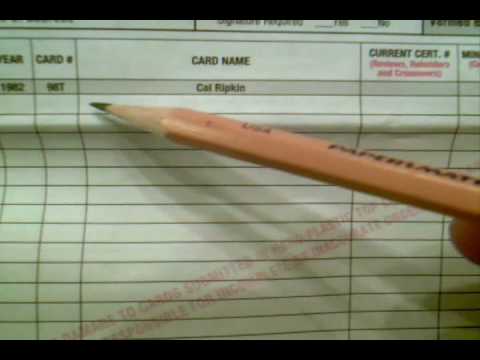

Hey and welcome back to Packers corner. My name is Troy and as usual, today is a good day. Unfortunately, I didn't receive anything in the mail today, so no goodies. But um, today is a good day as it always is. Today, I'm going to try and tackle something that is actually pretty difficult at times. I've had a few people ask me how to do it, so I'm gonna try and tackle it. As far as video-wise, here is how in the stink do I fill out the PSA forms. I don't know about you, but these things are not the easiest things in the world to fill out. I've had people ask me about it, and I've got buddies that even when I fill these out for myself and they send them in with me, they want to know how to do it. So in this video, I'm gonna try to do my best to tell you how to fill these things out correctly and even show you how to do your cards correctly. So when you send them in, you don't get phone calls letting you know you missed something or did something wrong. So bear with me, I'm gonna give this a shot. Here we go. Alright, here we go. Well, what do I do if I need to send something in the PSA to get graded? First of all, you have to be a member of PSA. So, of course, to join PSA, just go to PSA sports.com and join. If you can do it that way, or unless you've got a friend who is a member, you can send things in. For me, I've been a member for a while, so I've seen this page a few times. But it's not always that easy....

Award-winning PDF software

Why did i get a 1040 V Form: What You Should Know

May 14, 2025 — What is Form 1040-V? — IRS Form 941 Payment Voucher If you are delinquent on a federal tax bill, you may have received a payment voucher sent by the IRS. It is important to check and confirm the information you are receiving. You can view your voucher or make a payment online, by phone, or from any of the payment methods available at IRS.gov. You may be required to pay a late payment penalty (and possibly other fees) if you do not timely use the voucher. How to use the IRS Form 941 Payment Voucher Form 941 Payment Voucher can be used for the following reasons: To make a payment to the IRS for a delinquency in payment that is still past due, such as a balance that is due to the IRS and is past the due date. For more information, see IRS.gov/Payments. The amount of the payment is used to pay the balance in full or as close to full payment as possible. To make a payment for a delinquent Federal award or Federal contract where the total amount due was less than 3,000, a check is used until the balance is paid in full. To make a late payment that is still past due, the payment of the balance due by January 31 is made at the rate of 10 percent (to the extent the payment cannot first be made at the rate above). If you fail to make the payment by the date specified in the payment voucher, the IRS will use the funds in accordance with paragraph (d)(1) of section 4685 of the Internal Revenue Code of 1986. What is the IRS Form 941 Payment Voucher? The Form 941 Payment Voucher is a form that requires you to provide the following information: The name, address, and telephone number of the person (and business) to whom the payment should be made. A brief description of the federal award or Federal contract to whom the payment was to be used. The total amount paid in the current fiscal year. The date that the payment was due (which should be within the last two months. For more information, see IRS.gov/Forms5471).

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1040-V IRS online, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1040-V IRS online online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1040-V IRS online by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1040-V IRS online from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Why did i get a 1040 V